THANK YOU FOR SUBSCRIBING

Priority 2021: Achieving 100% Automation in Finance

Ekaterina Sejourne, CFO, Puma Energy Asia Pacific and Pierre Costa, Global CIO, Puma Energy

Ekaterina Sejourne, CFO, Puma Energy Asia Pacific

Many finance organisations have spent the past few years becoming more digital and more automated in the way that they function. The disruption created by the coronavirus is making the amount of progress CFOs have really made even more visible… We seem to agree that digitalization has become a condition for business survival and growth.

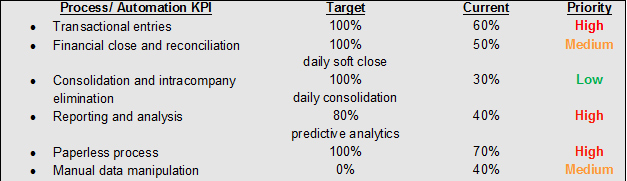

Let us take an inventory of where we stand in Finance in terms of digitalization and automation:

My finance team declared a 2021 goal of 100% automation in transactional finance activities and other tasks which could be described in an algorithm. We CFOs aspire to be valuable partners to the company businesses, without spending much time on crunching numbers, reshuffling them in various views or designing outdated dashboards. We are planning for the predictable and repeatable activities (more than 50% of what we donow) to be fully automated by the system, Artificial Intelligence (AI), bots and alike. We also envisage to automate the highly customized and intelligent reports for business users, which would propose relevant content in real-time. We include the historical and forward-looking information to enable better decision making and corrective actions. My personal dream is to get to the level of usefulness, relevancy and connectivity of information that would ‘addict’ business managers to check their Finance portal first thing in the morning, like we are now rushing to check our social media accounts as part of a morning routine.

We also require fully integrated systems that unify ERP and all other deployed solutions that manage the data as ONE.

We have gone through an extensive process of diagnostics and analysed various tools to address the manual and routine components of our work: entries, closing, consolidation and reporting. There are lots of solutions in the marketplace: we looked at innovative Blackline for account reconciliation and HyperAnna for an intelligent reporting bot as well as more traditional tools. They were addressing the certain pain point quite flexibly, taking data from our ERP into the cloud and executing the necessary manipulation. As a result of our project, we expect to save 2000+man-days (or 20%) per annum across the regional finance function. On the downside, the implementation and maintenance costs are negatively impacting our cost-benefit considerations.

So, I turned to our Global CIO, Pierre Costa, for guidance on how he can help to implement the tools and enable Finance to execute the functional role faster, cost-efficiently and with uncompromising high quality.

I began by asking Pierre if he thought it was realistic to achieve 100% automation in transactional finance and what roadmap he envisaged. This was his response:

Yes, we can, and we must. Automation is used in 2 main ways:

• For quite some time, it has been able to be coded, along explicit rules. Example, you can build a Bot which distributes your costs within different costs centers. This takes having an explicit deterministic way to do it (imagine, you will code the bot on how to do it, as you would explain a new hire).

Pierre Costa, Global CIO, Puma Energy

Pierre Costa, Global CIO, Puma EnergyThese programs can be coded within your ERP if most of the required inputs and parameters are there, or with an external bots solution (we use Exceptor) if a lot of required inputs are outside your ERP.

• But now, it can also be guessed by a system, and there we talk about Artificial Intelligence. To describe it, the AI system first looks at you doing it and this way it gets trained. Then using what it had seen plus some external data, it will start doing it. For each of its actions, the system will calculate a level of confidence, and will present it to you. It will ask you to confirm when the level of confidence is not high enough or when it does not know how to handle it. And by watching how you fix it, it will learn for next time. Any of us using digital banking with a spent analysis module have experienced it : example, in Switzerland, the system knows that Migros is food or cosmetics (external data), it has learned that in most of the cases, I go there for food (by watching how I correct the system-proposed allocations), and so it allocates by default to food with a high level of confidence.

• So we have the tools and we must target 100%, but it is asymptotic, and the real good thing with AI is that the effort you put in to fix is not only fixing, it is also teaching the system, so an investment for the future!

• One obsession we must have is to build the trust of the Business or the Function in the information provided by the systems and the actions the system makes. If you don’t trust someone, you will micro-manage this person and even redo what he or she did. We can’t afford for users to micro-manage our systems or redo what systems did. But this is more a change management topic.

I continued by putting the following to Pierre: We are still relying on paper documents for approval controls - print, sign, scan, retain. What are the prospects of rolling out the 100% electronic signature across all processes and systems?

We do have all the tools. We have gone through this during the start COVID, and the feedback is interesting as an electronic signature is really made of 2 things:

• If you want to avoid printing on paper, put your signature on it, and scan the signed copy to deliver it, then anybody has it : it is a feature of Acrobat reader DC (fill and sign) which does it perfectly.

• If you want to manage an auditable signature process, then Docusign is the tool we use. And as with any tool, you do need to define your signature process (who can sign what, until which amount, for which entity …) and you need a person to own the process and the tool. Then Docusign will be like a notary: it will watch you do it and then store all the evidence and the documents, being the trusted witness and the trusted documents holder.

Finally, given that Pierre has done a lot about operational reporting out of Power BI in other regions and I am interested in using it for the financial reporting as visually palatable, intuitive and real time data analysis.I asked him if he could tell us more about this experience?

Yes, PowerBI, or Tableau (we use both) are important, but they are only at the end of the data and analytics domain, and they are only one of the consumption methods. The simple structure we have adopted for our Galaxy project is a Data Lake in Microsoft Azure, in the cloud. This Data Lake receives all the data coming from our systems (our ERP, our Terminal Management systems, our Point of Sales…), which we consider as useful for downstream usage. It also cleanses it, structures it and even more important, documents / describes it. It also enriches it with external data (like for example, weather reports as weather can impact fuel consumption). Then you reach the PowerBI and Tableau which allow combining data to deliver insightful and valuable information for the business. But there are many other usages of this data, leveraging the libraries of applications within Azure, especially useful as we have more and more data but not more and more time to explore it: the system can use the history to set baselines, and then compare real time data to expected baseline, and raise business attention to exceptions, for them to act and positively impact bottom or top line. The system can also use the history to predict the future for you to make the best decisions. And the system could even prescript to you what it considers as the best decisions, using AI. But this is a topic for a future discussion Kate…

I thanked Pierre, assuring him that we are looking forward to working together in a new era of automation in Finance. As a CFO and a CIO teams we really can make a difference to re-imagining the performance of the business.